All Rs 2,000 notes must be exchanged by September 30, 2023, according to a statement from the RBI on Friday.

The Reserve Bank of India has decided to stop issuing currency in the amount of Rs 2,000 and has ordered everyone to swap their notes by September 30, 2023. However, the Rs 2,000 notes would still be accepted as legal money.

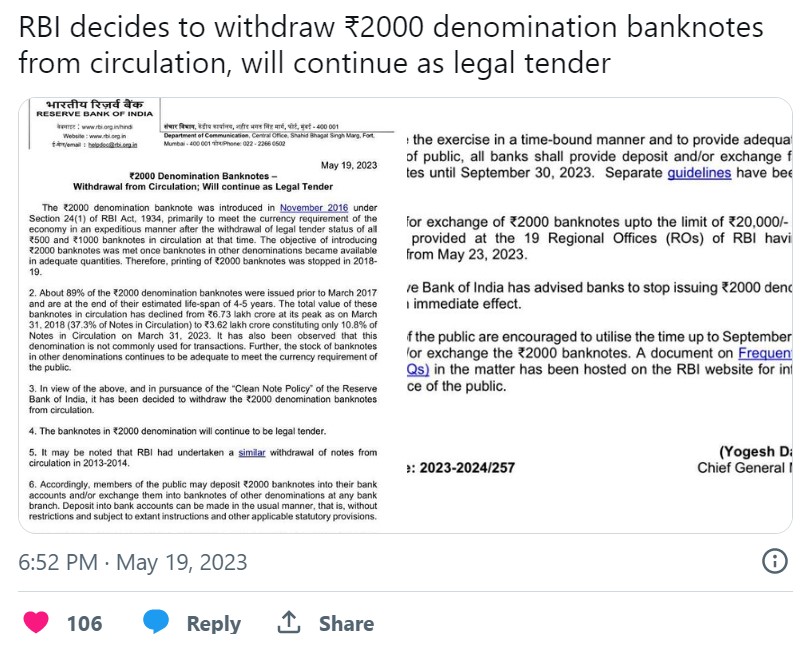

In a statement issued on Friday, the central bank said: “In accordance with the Reserve Bank of India’s “Clean Note Policy,” it has been decided to remove the denomination 2000 banknotes from circulation. The 2000-denomination bills will still be accepted as legal money. All banks must offer a deposit and/or exchange service for 2000-yen banknotes until September 30, 2023, in order to finish the exercise on schedule and give the people enough time.

In a statement issued on Friday, the central bank said: “In accordance with the Reserve Bank of India’s “Clean Note Policy,” it has been decided to remove the denomination 2000 banknotes from circulation. The 2000-denomination bills will still be accepted as legal money. All banks must offer a deposit and/or exchange service for 2000-yen banknotes until September 30, 2023, in order to finish the exercise on schedule and give the people enough time.

People can deposit Rs 2,000 banknotes into their accounts or swap them for notes of other denominations at any bank branch, according to the RBI. “Deposit into bank accounts can be made in the usual manner, that is, without restrictions and subject to extant instructions and other applicable statutory provisions,” it stated.

The central bank said, “Starting from May 23, 2023, exchanges of Rs 2000 banknotes into banknotes of other denominations can be made up to a limit of 20,000/- at a time at any bank, ensuring operational convenience and avoiding disruption of regular activities of bank branches.” Additionally, starting on May 23, the 19 Regional Offices of the RBI with issuing divisions will offer the ability to swap Rs 2,000 bank notes up to the maximum of Rs 20,000 at a time.

Following the demonetization of the previous Rs. 500 and Rs. 1,000 banknotes in November 2016, the new Rs. 2,000 currency note was released. The RBI claims that after money in other denominations was widely accessible, the goal of launching the Rs 2,000 banknotes was achieved. So, in 2018–19, production of the Rs 2,000 banknotes had already halted.

According to the Annual Reports of the RBI that Finance Minister Nirmala Sitharaman submitted to the Parliament in March, the total face value of the 500 and 2,000 rupee banknotes in circulation as of the end of March 2017 and as of the end of March 2022 was 9.512 trillion rupees and Rs 27.057 trillion, respectively.

“Banks have not been issued any instructions to stop replenishing ATMs with Rs 2,000 notes. According to prior usage, customer demand, seasonal trends, etc., banks determine the quantity and denominational requirements for ATMs on their own, she had previously stated.